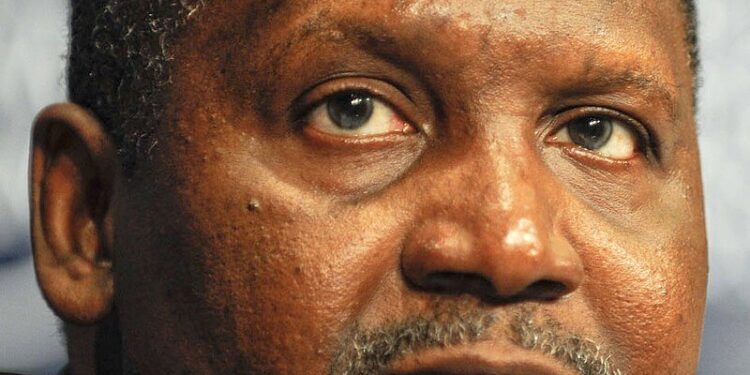

Africa’s richest man, Aliko Dangote, has dropped out of the top 60 world’s wealthiest people and is now standing in 72nd place. The Nigerian businessman’s wealth has surged by over $1.7 billion this year to $20.2 billion as of 8 June 2022, thanks to an increase in the market value of his cement company.

Back in May, Dangote was ranked the 67th richest person on the list, while Johann Rupert overtook Nicky Oppenheimer to reclaim his title as South Africa’s richest man. Since the beginning of the year, Rupert has lost over $2 billion due to the Russia and Ukraine conflict that has caused the share price of the Swiss Luxury goods holdings’ to fall to its lowest level in more than two years.

Chances are that Dangote will likely reclaim his spot on the top 60 billionaires list soon enough, considering his bets on the newly launched fertiliser plant and the Dangote Refinery that is expected to commence operations by Q3 2022.

In the latest development, a report published by Fitch, the world’s biggest global rating agency, alleged that the Aliko Dangote was seeking to raise an additional $1.1 billion (900 billion) to complete the refinery but has invested all his cash and even borrowed to finance the refinery project.

According to the report, the Dangote refinery project is still on track to be completed by 2023 and requires an additional USD1.1 billion capex in 2022 to be partly funded by the new bond.

The report adds that Dangote Industries Limited (DIL) is planning to establish a local bond programme amounting to USD750 million to partially finance the completion of its refinery and petrochemical plant. DIL’s subsidiaries – Dangote Oil Refining Company Limited (DORC) and Dangote Fertiliser Limited (DFL) – will be co-obligors under the proposed programme.

“Funding for the completion of the refinery project is expected to be partly covered by proceeds of the new bond. If the transaction is not successful, or should completion costs overrun or market conditions in the cement or urea sector deteriorate materially, we do not believe that DIL’s existing creditors would have further lending capacity. We believe that further asset sales, either in cement or stakes in the projects, would be the more likely options to address funding of the refinery,” the report stated.

Source: Business Insider Africa