The NMB Bank yesterday handed over 30.7bn/- to the Government being payment for dividend following the bank’s solid financial performance last year.

The bank last year recorded 290bn/- Profit After Tax (PAT) and during its annual General Meeting held in Dar es Salaam a week ago approved 30.7bn/- pay for its shareholders.

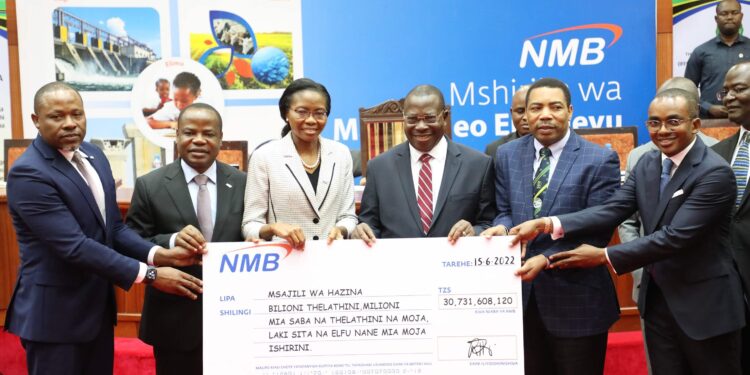

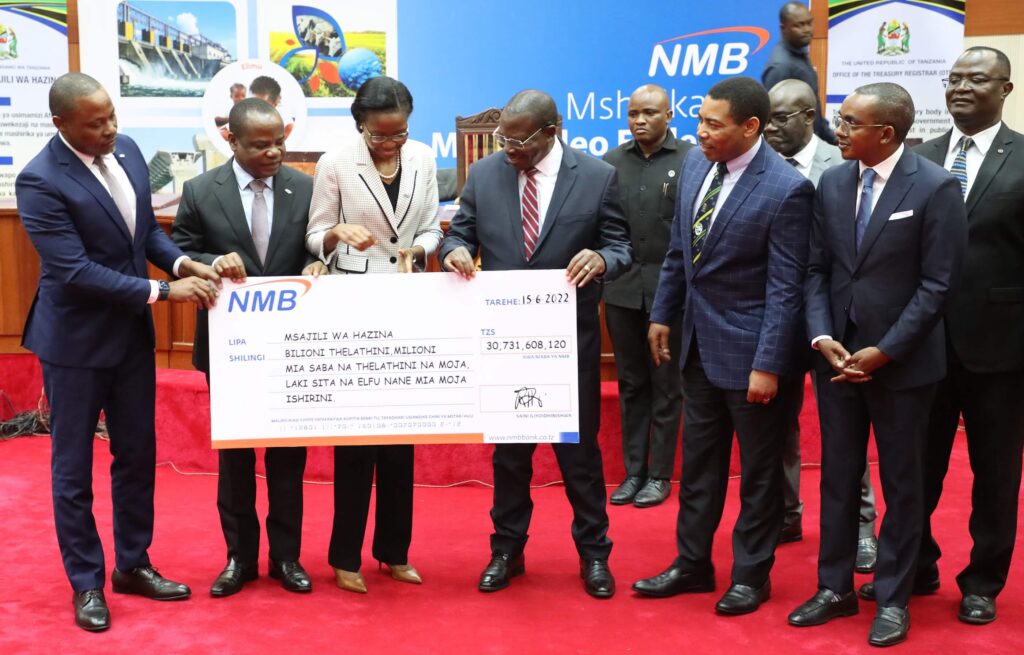

The Vice President Phillip Mpango, who was in the company of the Finance and Planning Minister, Dr Mwigulu Nchemba, received a Sh30.7 billion dummy cheque yesterday from the NMB Bank Plc’s board chairman Edwin Mhede, chief executive officer Ruth Zaipuna and chief finance officer Juma Kimori.

Speaking during the event, Dr Mpango said the money – which had already been deposited in the account of the Treasury Registrar – expressed his delight to see the dividend from Tanzania’s most profitable lender increasing.

The 30.7bn/- is an increase of almost 41 per cent compared to a dividend of 20.8bn/- that the government – which owns a 31.8 percent stake in NMB Bank Plc.

When he graced a similar event last year, Dr Mpango asked the NMB Bank Plc management to come up with more innovative solutions and raise its dividend to shareholders.

With the money, the government has now received a total of Sh80.544 billion from NMB Bank Plc during the past five years.

“I am happy to see that you have come up with a better dividend. When I go to welcome the President [from her visit to Oman], this is one of the things that I will inform her of. Congratulations,” Dr Mpango said.

He urged NMB Bank Plc to extend its wings further and reach more and more rural folks.

Earlier, the NMB Bank CEO Ruth Zaipuna told Dr Mpango that last year, NMB Bank’s net profit rose by 41 per cent to 290bn/ from 206bn/- recorded in 2020.

“In ensuring that NMB operates sustainably, we have managed to raise its capital to Sh1.3 trillion. We maintained a high level of operational efficiency and as a result, the cost to income ratio was reduced to 46 percent,” said Zaipuna.

The banking regulator, the Bank of Tanzania, wants commercial banks to maintain costs to income ratios of not more than 55 percent while levels of Non-Performing Loans (NPLs) are to be contained to not more than five percent of total gross loans but NMB closed the year with only four percent in NPLs.

She said it was on the back of such a splendid show, fueled by digital approach in service delivery, that the NMB Bank Plc received a number of international awards last year, including bagging the Best Bank in Tanzania from Euromoney awards for excellence for nine years consecutively.

The Bank was also recognized as the Best Retail Bank in Tanzania by the Global Banking and Finance Awards.

“We have invested massively in digital service channels. We raised the number of banking agents to 10,194 in 2021 from 8,410 in 2020,” she said. In his remarks, the NMB Bank Plc board chairman, Dr Edwin Mhede said the bank was doing everything possible to raise its performance further this year and yield more lucrative returns to its shareholders