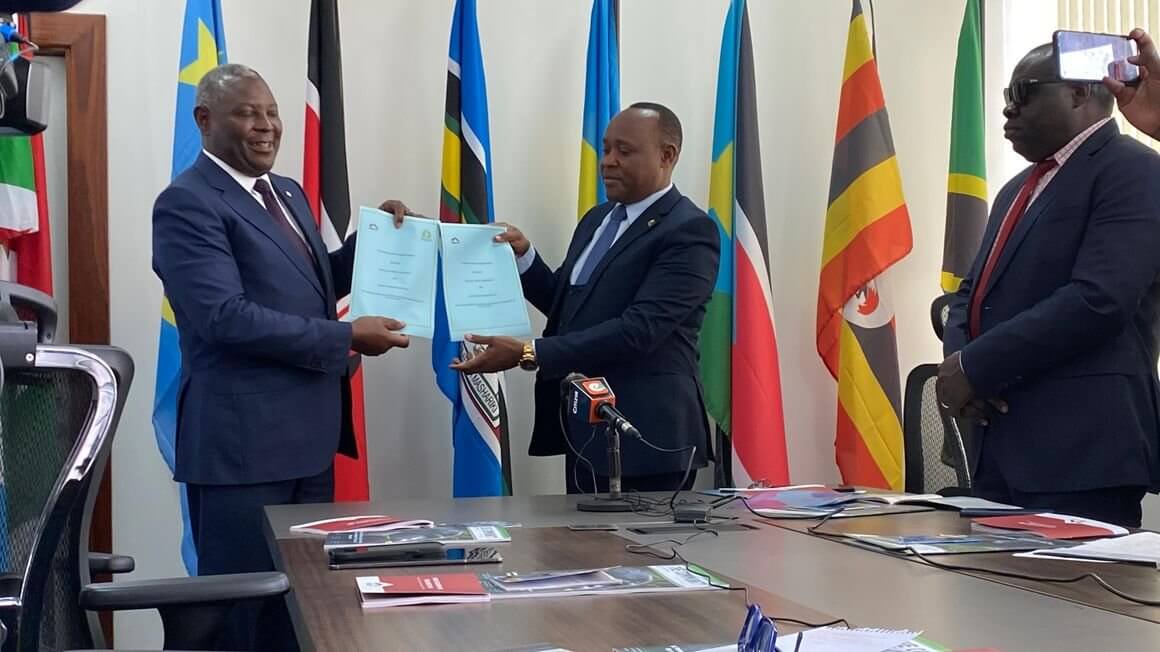

Regional lender Equity on Thursday signed a memorandum of understanding with the East African Community (EAC) to help fast-track its Africa resilience and recovery plan that largely targets small and medium enterprises.

The deal was signed in Arusha by Equity CEO James Mwangi and EAC Secretary-General Peter Mathuki on the sidelines of the EAC Ordinary Heads of State Summit.

The MoU is a vehicle for financial support and development financing using the EAC infrastructure of the Common Market and targeting farmers, manufacturers, energy and social services providers and to stimulate intra-continental trade, said Mr Mwangi.

He said the bank is making part of its $13 billion balance sheet available for the region’s entrepreneurs while 16 development financiers, including the International Finance Corporation, African Development Bank and European lenders, are bringing in more for lending. He said $2 billion is already available for borrowers.

Mr Mwangi noted that the EAC is the best integrated and connected economic bloc in Africa and, therefore, a good vehicle to help African businesses supply the world markets, which have been hit by disruptions blamed on Covid-19 and the war in Ukraine.

“The world is looking for an alternative manufacturing hub and the memorandum we have signed is to allow the business community to operate within the framework of the EAC protocols. We want to operate in a common infrastructural and governance structure to be able to supply the global market,” Mr Mwangi said. “Essentially, we are saying let’s bring equity for everyone and we come together under the Common Market.”

Noting that in 1960 Congo and Nigeria produced 90 percent of the world’s palm oil used for making edible oil, which has been in short supply, Equity Bank will be looking to fund farmers in the region to produce it for the global market.

Dr Mathuki welcomed the plan, saying it promises to bring about African solutions to African problems.

“Let’s not over-depend on foreign suppliers with all these shocks. We appreciate the private sector’s participation in the region’s economic recovery,” he said.

SOURCE: THE EAST AFRICAN