Aim-listed Shanta Gold has started the second half of the year strongly with 7 259 oz of gold produced in July and 6 707 oz produced in August, following production increases in the quarter ended June.

CEO Eric Zurrin says the company is going from strength to strength, with material increases in revenue recorded in the first half of the year, as well as into the second half of the year so far.

The company posted revenue of $51.9-million in the first half of the year, with a notable increase in revenue from $19.8-milion in the first quarter to $32.1-million in the second quarter of the year.

Gold production totalled 28 947 oz for the six months ended June 30, on par with the prior year’s half-year production of 28 842 oz.

Shanta declared an interim dividend of 0.10p apiece, after posting earnings before interest, taxes, depreciation and amortisation (Ebitda), excluding expenditure on its Singida and West Kenya projects, of $14.1-million in the six months under review.

This compares with Ebitda of $17.4-million posted in the six months ended June 30, 2021.

The company spent $16.5-million in capital expenditure in the reviewing period.

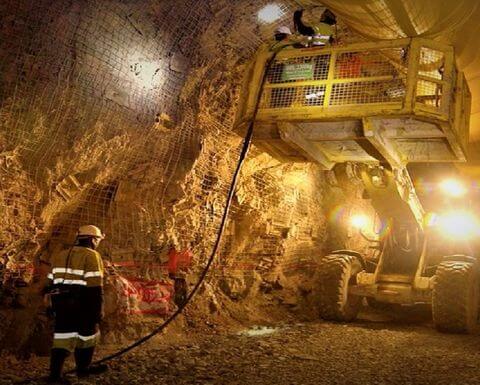

Shanta’s asset portfolio includes the New Luika gold mine and Singida project in Tanzania, and the West Kenya project, in Kenya.

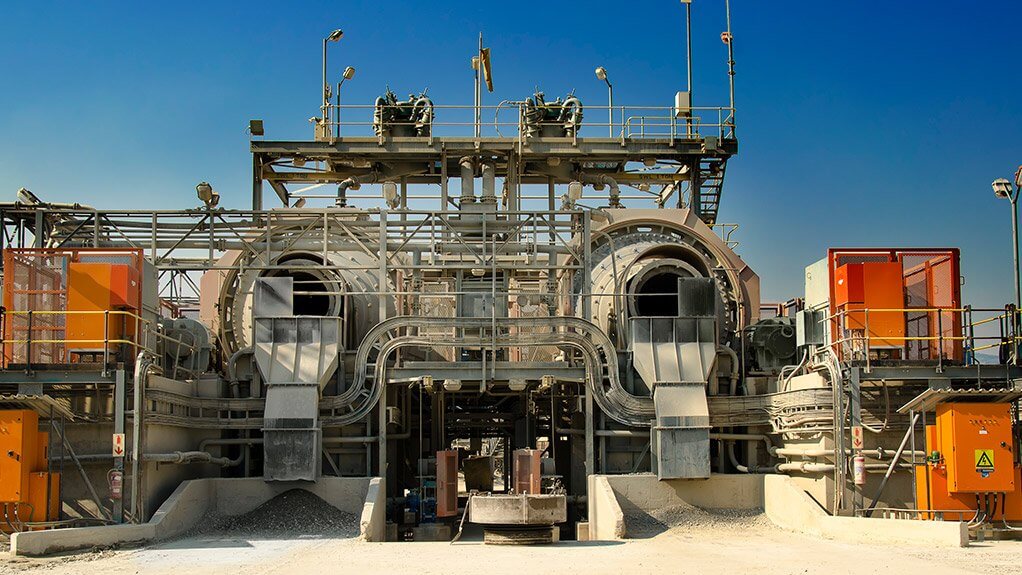

Zurrin reports that the Singida project development is progressing at a good pace, with 70% of construction having been completed.

The company expects the mine to produce its first gold in the first quarter of next year, before ramping up to a 100 000 oz/y operation.

In the six months under review, Shanta increased its West Kenya project resources by 31% to 1.55-million ounces contained. Indicated resources have increased by 221% to 378 000 oz, grading 11.7 g/t.

Shanta has $14.3-million of cash and available liquidity on hand.

Drilling remains ongoing at the West Kenya project, with up to 75 000 m of drilling planned to be completed in the fourth quarter of the year. The company has started with a feasibility study on the project.

Shanta remains on track to produce between 68 000 oz and 76 000 oz of gold for the current full-year.

The company has had to increase its all-in sustaining cost guidance for the year from between $1 050 and $1 250/oz to between $1 150/oz and $1 275/oz, owing to cost inflation influencing inputs such as fuel, emulsion, steel supports and consumables.

Since June, Shanta has entered into a $20-million senior debt facility agreement with Stanbic Bank of Tanzania, of which funds were disbursed on July 15.

As a condition to this debt facility agreement, Shanta entered into a zero-cost collar contract over the 12-month period from August this year to July 2023 of 1 333 oz a month, with a floor price of $1 600/oz and ceiling price of $1 950/oz.

SOURCE: MINING WEEKLY