Manufacturers of excisable goods have raised serious concerns over the applied Electronic Tax Stamp (ETS) urging the Tanzania Revenue Authority (TRA) to consider lower the rates further as it costs them nearly half of what they pay in excise duty.

Local manufacturers under their umbrella, Confederation of Tanzania Industries (CTI), said that despite government’s move to reduced 4 per cent of the entire costs earlier this year the reduction was low and quite insignificant this urging for affordable charges agreeable by both the Government and the manufacturers.

Earlier this year, CTI had appealed to the government through TRA to institute a 70 per cent reduction on the ETS rate in order to enable them to be competitive enough within EAC region.

Available data by the CTI indicates that, during the trading period ending July 2022, eight manufacturers of alcoholic beverages, soft drinks and tobacco products paid a whopping TZS 100 billion (US$ 43.1 million) in total to the Sicpa a Swiss foreign supplier of the technology.

This is a huge amount paid within three years’ time-frame since the technology was first rolled out by the government in June 2018 and the first phase was effected on January 15, 2019 whereby electronic stamps were installed on beer, wines and spirit and installed in 15 factories operating in the country.

The eight manufacturers who are the leading tax payers in the country say, the system is expensive adding that it is a burdened to them to bear the cost.

The companies include Tanzania Breweries Ltd, Serengeti Breweries Ltd, Coca-Cola Kwanza, Nyanza Bottling, Bonite Bottlers, SBC Tanzania, Bakhresa Group and Tanzania Cigarette Company.

The firms argue that much as ETS has indeed helped to raise excise duty collections, most of the increase was largely due to expansion of the tax base with some manufacturers who used to operate informally being roped into the formal economic system.

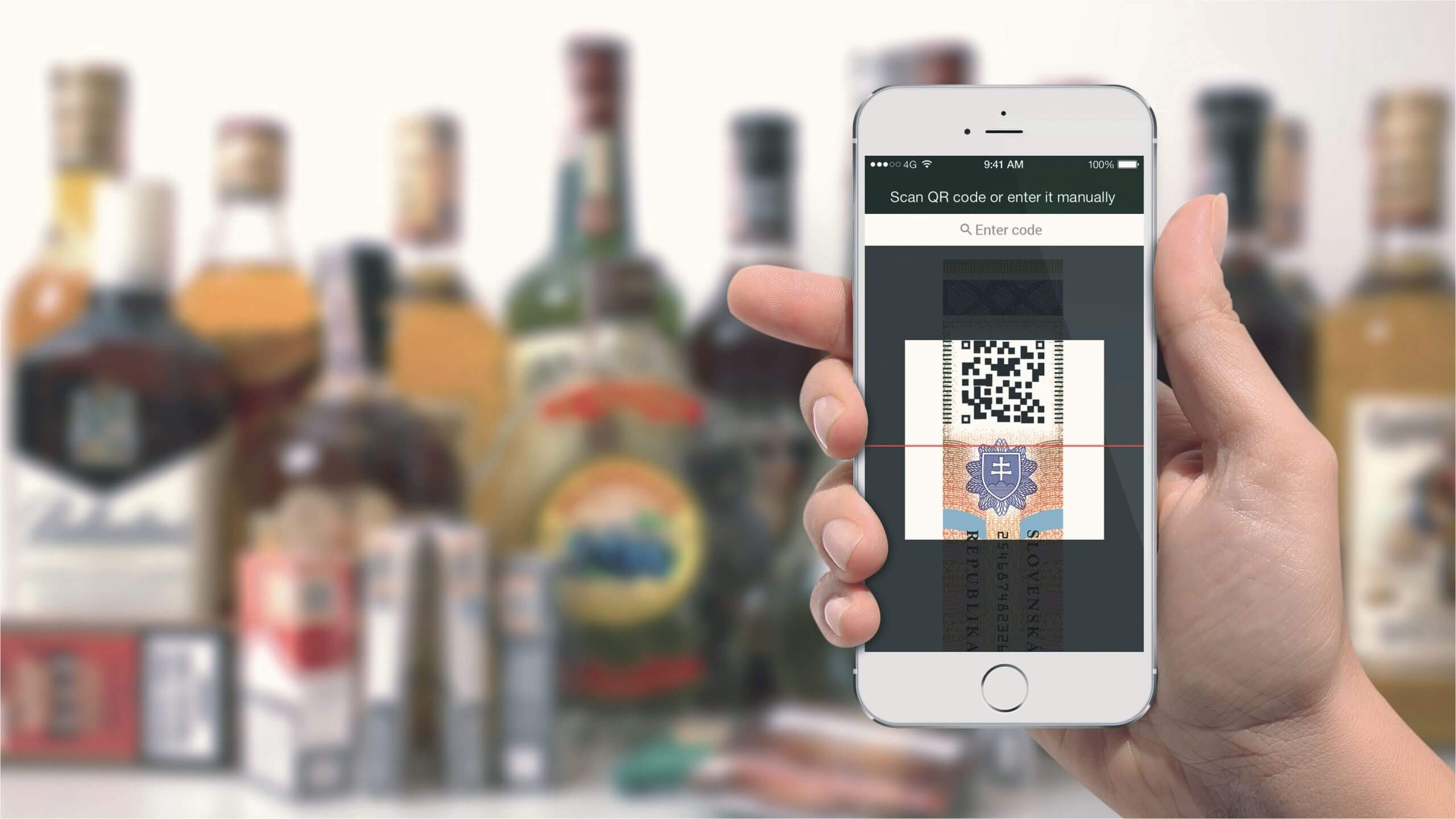

ETS system was intended to replace the current paper stamps currently applied worldwide and is described as an adhesive label that uses advanced digital coding technology and is printed or affixed directly on the product packaging of excisable goods with a view to avoid tax evasion.

When contacted by The Business Wiz for comment on the matter, the Tanzania Revenue Authority (TRA) Director of Tax-Payers Education Richard Kayombo said that part of its efforts to reduce prices further to a competitive rate the government, the Government announced an international tender to get a new supplier who would be able to provide the service at a slightly cheaper price rates.

He noted that manufacturers who are the key stakeholders in this matter were adequately engaged in the whole procurement process and that up to now, the government is waiting to pick up whoever would accept cheap price rate that would be more affordable for them.

“Another advantage with this ETS system for manufacturers is that since January this year, when the government recommended 4 percent reduction in payments, now the amount is being settled in shillings and not in dollars as it was before,” Kayombo said.

ETS system enables the government address long standing challenges geared towards improving tax administration as well as replacing the physical paper stamps that were heavily linked to incidents of tax evasion and trace to identify fake and original products.

Two weeks ago, TRA said in its reports that it has registered tremendous achievements in tax collection through ETS even as manufacturers maintain that they are paying through hardships.

Data provided shows that nearly 500 companies had been registered for ETS by the end of August 2022, up since the service was first rolled out three years ago.

The collections from these manufacturers has grown from Tshs. 1.6 trillion in the preceding three years to Tshs. 2.1 trillion in the three years after the launch of ETS.

The government through TRA is optimistic that the ETS systems has helped in safeguarding the government’s revenue by ensuring that there is full utilization of modern technologies in obtaining real time production data from the manufacturers.

During the 2021/22 fiscal year as of May, 2022 TRA had managed to collect Tshs. 19.96 trillion from the targeted Tshs 20.4 trillion as the ETS system played a key contribution in the whole revenue collection process