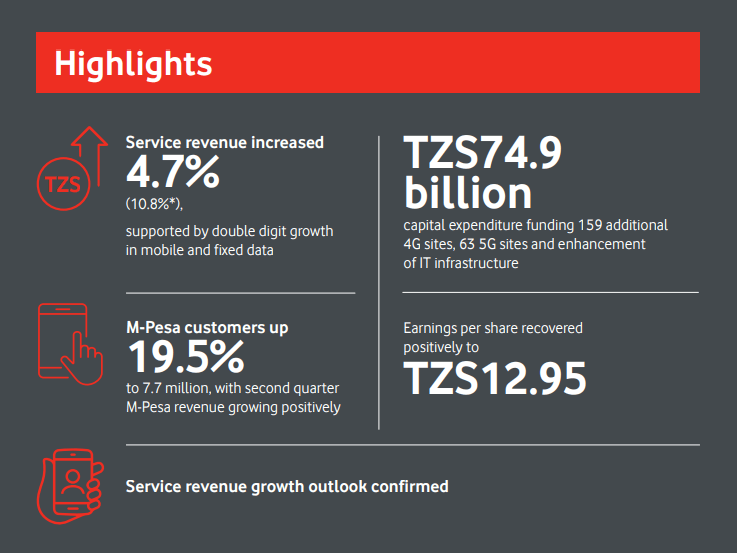

Vodacom Tanzania’s service revenue increased 4.7 per cent to 508.0bn/-, with strong growth in data and fixed revenue partly offset by intensified competitive pressure in the voice segment the company said in its latest Q3 interim financial results.

The growth was supported by our commercial efforts focused on new customer acquisition and retention, new services’ penetration and increased usage per customer across its services.

During the period, the company added 641 000 customers driven by both open market and segmented initiatives which contributed to a 0.8pp expansion in customer market share, currently at 30.5 per cent.

Adjusting for the 29.3bn/- estimated impact from the levy on mobile money transfer and withdrawal transactions, underlying service revenue grew 10.8 per cent, reflecting successful commercial execution.

“In the second quarter, service revenue increased 14.5 per cent, attributed to strong double digit growth of 41.7 per cent in data revenue and 13.9 per cent growth in M-Pesa revenue,” the Vodacom Tanzania Managing Director Philip Besiimire said.

The company’s mobile voice revenue however decreased by 1.9 per cent to 143.8bn/-, with ARPU declining 7.5 per cent as a result of continued competitive pressure in voice bundle pricing.

“This competitive pressure resulted in a 23.0 per cent decline in average price per minute while minutes of use increased by 19.7 per cent. In the quarter, mobile voice revenue momentum improved and was up 3.6 per cent attributed to 5.8 per cent active customer increase,” the company said in a statement.

Vodacom’s M-Pesa revenue declined 2.9 per cent to 169.6bn/-, impacted by the levies.

Adjusted for the estimated impact of the first quarter levies, the underlying M-Pesa revenue for the first half of the year grew 12.5 per cent but encouragingly, in the second quarter, M-Pesa revenue increased 13.9 per cent offsetting the decline of 16.3 per cent in the first quarter.

“Growth in the second quarter was supported by the 1 July 2022 levy reduction of 43 per cent, as well as, ecosystem expansion through adoption of traditional products and new growth areas, comprising of financial services, merchant services and international money transfer (IMT). Revenue from our new growth areas increased by more than 90 per cent, and contributed 22.6 per cent of total M-Pesa revenue, an increase of 11.4pp,” the company said.

Vodacom however remained optimistic that the decision by government to review the levies on mobile money transfer and withdrawal transactions introduced on 15 July 2021, will have an uplift in financial inclusion.

From 1 July 2022, the government facilitated a further 43 per cent levy reduction for the top-band, marking a cumulative 60 per cent reduction for that band since introduction.

“This intervention is particularly relevant to our peer-to-peer and cash out transactions which posted a modest recovery in the second quarter and our ability to expand financial inclusion to more Tanzanians,” Besiimire said.

Vodacom said its M-Pesa customers recovered to 7.7 million, up 19.5 per cent with its M-Pesa revenue trajectory also reflecting its ongoing focus on driving innovative products by leveraging on Its strategic capabilities from the M-Pesa Africa hub, and accelerated opportunities in new growth areas including digital loans and overdraft services, insurance and merchant payments.

“Our M-Pesa app transition into a super-app is making good progress. The super-app will provide a one stop shopping and financial services experience to our over 400 000 app users,” Besiimire said

The company remains positive on the potential to deliver growth and shareholder value, while also focusing on its social contract and purpose.

“Vodacom Tanzania is well positioned to contribute towards Tanzania’s economic growth and improved societal living standard. We will continue leveraging on our capabilities to offer segmented multi-products through our ‘systems of advantage’, enabled by our strong customer value management and machine learning platforms,” Besiimire said.

The company said it will continue to closely monitor the impact of the Russia-Ukraine war, which is driving increases in fuel and commodities prices, inflation, foreign currency exchange volatility and supply chain disruptions.