Market activities at the Dar es Salaam Stock Exchange (DSE) fell by 9.9% to 4.71bn/- in August this year according to the available data from the DSE.

The Tanzanian Share Index (TSI) however continued its upward trajectory, climbing by 1.44%, while domestic market capitalization closed the month at 11.01trn/-

The TSI has maintained its rally since 2021, mainly driven by the banking sector’s significant growth over the past two years. The TSI has seen a 7% increase since the beginning of the year and a 19.5% increase compared to the end of 2020.

According to the Alpha Capital Head of Cpital and Analytics Imani Muhingo, foreign investors accounted for 11.96% of total divestments and only 2.06% of total equity investments, resulting in a net foreign outflow of 466.59m/- ($0.18 million), a 76% decrease from July’s figure.

“During August, only three counters experienced positive price movements, while seven counters saw declines. NMB’s strong performance and weight on the TSI contributed to the overall index’s positive performance despite several counters ending the month in the red,” Muhingo said.

DSE also recorded gains following a 34% profit growth announced at the end of July.

The uptick on the DSE counter follows a 34% six months profit growth announced in the end of July.

The Exchange reported a 17% revenue growth driven by listing fees and investment income. The 43% growth in listing fees can be attributed to a more than 10% increase in the outstanding Treasury bonds listed on the Exchange since Treasury bonds account for more than 90% of listing fees income and more than 35% of the Exchange’s total revenue. Operating expenses rose by only 5%, which led to a 581bps gain on the operating margin.

Gainers of the month

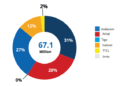

DSE top listed banks including CRDB and NMB continued their bullish run with CRDB remaing the top mover for the month, accounting for 61% of the total equity turnover.

On the other hand, NMB experienced an 85% increase in activities, to realize a turnover of 520.93m/. Growth of activities on the NMB counter originated from an impressive half-year performance.

NMB also emerged as the top gainer, with a price increase of 11.6%.

Additional notable movers included Vodacom and TBL, both of which saw prearranged block transactions at significantly discounted prices, and accounting for 8.95% and 5.31% of the total turnover for the month respectively.

The monthly weighted average price of Vodacom was 43% lower than the counter’s closing price. Similar was for TBL with a 41% discount from the closing price.

Losers of the month

In contrast, Mkombozi Commercial Bank (MKCB) suffered the most significant price decline during August, dropping by 11.54%. MKCB resumed profitability in 2022, recording an EPS of 239/-, a significant improvement from the negative 79/- in 2021. However, with a non-performing loan (NPL) above 5%, MKCB would not be eligible for dividend payments according to central bank directives.

Other counters that experienced price declines in August included Maendeleo Bank (MBP – 10%), TCCIA Investment Company Ltd (TICL – 3.23%), CRDB Bank Plc (CRDB – 3.16%), Swissport Tanzania (SWISS – 2.44%), Tanga Cement (TCCL – 2.17%), and National Investment Company Ltd (NICOL – 1.02%).

CRDB’s price drop was attributed to a 3% profit growth for the first six months of 2023, considered an underperformance by the market.

TICL and NICOL experienced price declines despite positive developments in August.