In the bustling streets and neighborhoods of Tanzania, a growing number of young people are betting on striking it big. Attaining this hope is made easier now with virtual gambling- betting can be done conveniently with the touch of a few buttons. In the palm of many Tanzanian hands there is a device, usually a mobile phone, which makes gambling accessible wherever you are.

Juma Fundi, a 27-year-old university graduate, stated that “the increase in the number of people living through betting is a result of unemployment; betting has become a source of income. Some people rely solely on betting and have no other job.” His sentiment resonates with many others like Joyce Mfuko, who observes that “you see a young person with all six betting groups; all their hopes are on betting, hoping to strike it big.”

However, Louis Mushi, a passionate advocate for the youth, believes there’s more to the story. Louis remarked that the revenue collections that government obtains from the betting business has escalated the problem.

“In the years 2012/2015, the government changed the sports betting law and introduced online casinos where they agreed that for every Odd placed by an individual, the government would deduct a 6 percent tax. If someone wins, the government will take 18 percent. Since then, there has been a proliferation of betting companies in Tanzania” he said.

Mushi asserted that “the government, which blames the youth for betting today, did not consider the addiction that exists in betting, nor did it consider how the unemployment situation might push young people into this addiction.”

The Betting Industry in Tanzania

Tanzania’s betting industry is flourishing, with numerous bookmakers tapping into this lucrative market. Prominent names in the industry such as Betika, Betway, Sportspesa, Bikosports, and 1XBet have established a strong presence. This surge in competition has elevated the quality of services offered to customers, including a wide range of sports betting options such as football, cricket, boxing, and athletics.

Online sports betting has become very popular in Tanzania, offering benefits like live betting, user convenience, privacy, and enticing bonuses and promotions. The top betting sites in the country provide competitive odds and attractive jackpots, making the experience all the more thrilling.

In a nation where the pros and cons of the betting business are hotly debated, one thing is clear: the industry’s impact on Tanzania’s youth and economy is a complex issue that demands careful consideration and possibly further regulation. More and more Tanzanians are becoming concerned that an addiction to gambling is on the rise, aided in no small part by the easy availability of affordable betting. Like other addictive behaviors, the question becomes whether one should regulate the supply side by placing restrictions on betting, or on the demand side by informing the public of what they should do with regards to avoiding addiction and other betting-related problems.

The Revenue Trend

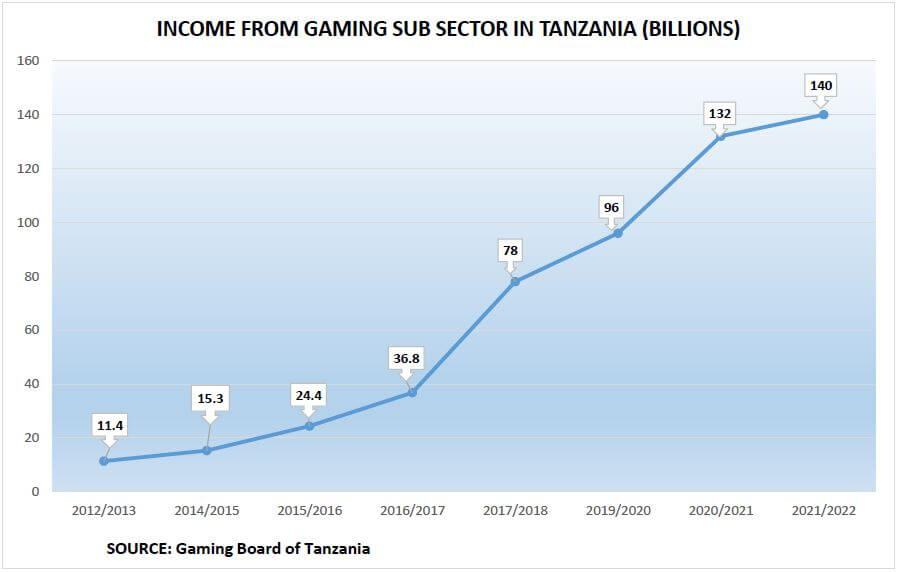

The Gaming Board of Tanzania (GBT) plays a crucial role in regulating and monitoring the gaming sector in the country. According to data from the GBT, the government is reaping significant benefits from the betting industry. As reported by local media outlet The Citizen, income from the gaming subsector reached 140bn/- , up from 132bn/- recorded in 2020/2021.

Previous data by the GBT also shows an upward trend and how the industry has been growing.

According to data provided by the Gaming Board of Tanzania (GBT) and reported by the ‘Daily News,’ the revenue trend for gaming activities in Tanzania witnessed a remarkable surge from 2013 to 2020. In the 2012/13 fiscal year, the government collected 11.4bn/- in taxes from gaming activities. This figure saw a significant uptick, reaching 15.3bn/- in 2014/15.

The trend continued its upward trajectory, with tax revenues increasing progressively to 24.4bn/- in 2015/16 and further surging to an impressive 36.8bn/- in 2016/17.

The fiscal year 2017/18 saw a substantial revenue intake of 78bn/-, indicative of the gaming industry’s growing prominence. Finally, in the financial year 2019/2020, the revenue from gaming activities reached its zenith, totaling an impressive 96bn/-

This remarkable increase underscores the significant role the gaming sector has played in contributing to the government’s revenue streams during this period.

Information from the board as posted in 2022 shows that sports betting companies are taxed 25 per cent, SMS are taxed 25 per cent, each slot machine is charged $43.11 US dollars, the nationals lottery is taxed 20 per cent and machine sites 25 per cent. Physical casinos are taxed 18 per cent while digital casinos are taxed 25 per cent of revenue after winnings. The combination of high taxation and increasing volumes of betting yield the kind of revenues that may affect how regulation of the industry is carried out.