NMB Bank Plc has made history after becoming the first bank in Sub-Saharan Africa to list its gender bond in Luxembourg Stock Exchange (LuxSE).

LuxSE is the world’s leading exchange for listing of international debt securities and is highly recognized for advancing gender finance and gender-lens investing.

The bank’s gender bond christened ‘Jasiri bond’; with its objective of bringing much-needed financing to women-owned micro, small and medium-sized enterprises in Tanzania and within East Africa, was displayed on the Luxembourg Green Exchange (LGX) during a special two-part ring the bell ceremony held this afternoon.

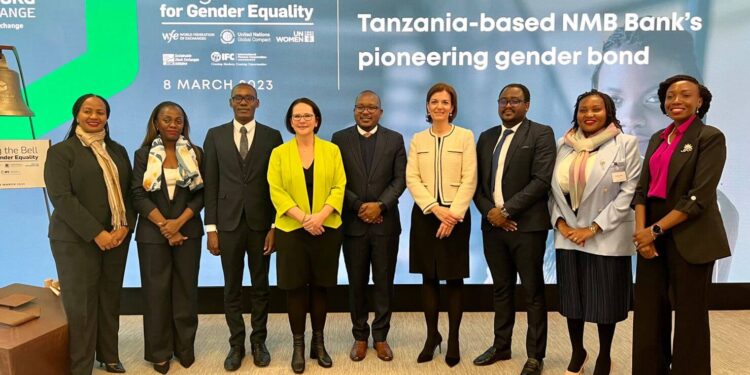

As part of International Women’s Day celebration, NMB Bank led by our Treasurer, Aziz Chacha joined Luxembourg Finance Minister Yuriko Backes CEO of LuxSE Julia Becker and Counsellor from the Embassy of Tanzania in Brussels Alphonce Mayala to celebrate the listing of the bond whose proceeds will provide women in Tanzania with access to the necessary financing to start or grow their business.

NMB Bank’s three-year bond – which was issued in February last year was oversubscribed by 197 percent when 74.26bn/- was raised against a target of 25bn/- and a green shoe option of 15bn/= .

The government last year said that the bold move for NMB Bank’s issuance of ‘Jasiri Bond’ and its ensuing massive oversubscription outcomes offers best lessons on how to economically develop Tanzania.

Gracing the listing of the Jasiri Bond at the Dar es Salaam Stock Exchange (DSE) last year, the Deputy Permanent Secretary in the Ministry of Finance and Planning,Lawrence Mafuru said it was interesting to note that working with various financial sector experts, the bank innovated and managed to issue the bond despite the fact that at that time, the regulations for issuance of such financial instruments had not been approved.

“So while it is interesting to celebrate the oversubscription, in my view, what matters more is the courage (Ujasiri) and innovativeness behind issuance of NMB Bank’s Jasiri Bond at a time when rules had not been approved,” Mr Mafuru, who is himself a respected banker and financial expert, said.

According to the DSE chief executive officer, the NMB’s Jasiri Bond was issued at a time when the Capital Markets and Securities Authority (CMSA) was only about to finalise regulations for issuance of all financial products that falls under the ‘sustainable instruments’ category.

“Sustainable Instruments are a new product in this market. In fact, the CMSA approved the regulations for such instruments on March 1, 2022. We commend NMB Bank for acting as a stimulant in forcing us to come up with the regulations for issuance of sustainable instruments,” he said.

NMB Bank Plc Chief Executive Officer Ruth Zaipuna said that in line with the objective of issuing the bond, the oversubscription means that NMB Bank now has more money for extension of affordable financing for women-owned or women-controlled enterprises and/or businesses whose products or services directly impact a woman.

“The other interesting aspect is that 96 percent of the 1,630 investors bought the bond through our branches….The oversubscription demonstrates the trust that investors, both local and foreign, have over NMB’s operations and a vast opportunity to invest in the local capital markets,” she said.