The price of NICOL is up 22% since the beginning of the year following a substantial annual profit growth of 54% during the year 2022.

The impressive performance originates from increased investment income as the company beefs up its diversification into Treasury bonds.

What has changed since the last report?

• Through the diversification strategy, 6mln NMB shares were sold during 2022, and the proceeds used to purchase TZS 18bln worth of Treasury bonds.

• NICOL’s holding of NMB dropped from 5.3% to 4.1% of the bank during the year 2022, making up 61% of NICOL’s investment holdings and 48% of its total assets. The reallocation lowers dividend income and elevates interest income projections throughout the forecast period.

• The company took out a seven years TZS 21.6bln bank loan at 11.5% in December 2022, and expects a 12.8% return from ‘unclarified’ investments of loan funds, realizing a 1.3%margin. The aggregate discounted value of the margin throughout the loan period, with WACC as the discount rate, amounts to an estimated TZS 3bln, leading to an upward revision of the pretax income forecast.

• NICOL advanced a 12 months TZS 3bln loan facility, at 12.5%, to a 99% owned subsidiary, NICO Land Development Company Ltd, to purchase land for resale. The subsidiary was formed to conduct real estate business.

• Almost overhauled the Board by appointing new five non-executive board members as the tenor of the previous board expired. The five new board members were appointed by the Executive Committee in February and approved in an Extra-Ordinary General Meeting in May 2022. The current board has six members, including the Chairman who has served since 2012, and was last re-appointed in 2018.

Annual Operational Performance for 2022

The NMB divided growth led to a 22% growth in dividend income for the year 2022. As a result of the diversification away from the bank, dividend from NMB as income to NICOL only grew by 24% compared to 41% growth of the bank’s dividend payout.

During the year 2021, NICOL disposed 20% of their NMB holdings at the time and reinvested the proceeds into Treasury bonds. As a result, interest income grew by 121% during the year 2022, leading to an aggregate investment income growth of 46%. Dividend income accounted for 64% of investment income, down from 77% in 2021.

The operating margin for the year went up 470bps to 76.9% despite a 39% growth of operating expenses. Administration expenses grew the most due to two extra-ordinary general meetings held during the year to appoint the board. Finance costs grew from TZS11.2mln to TZS 87.7mln due to the processing fee of the loan secured during the year.

We expect finance costs to be above TZS 2bln/- for the year 2023 as the loan service kicks in. The net margin for the year 2022 also went up 450bps to 72.6%. The EPS for the year was TZS 97/-, while lacking a clear dividend policy, the expected dividend is uncertain.

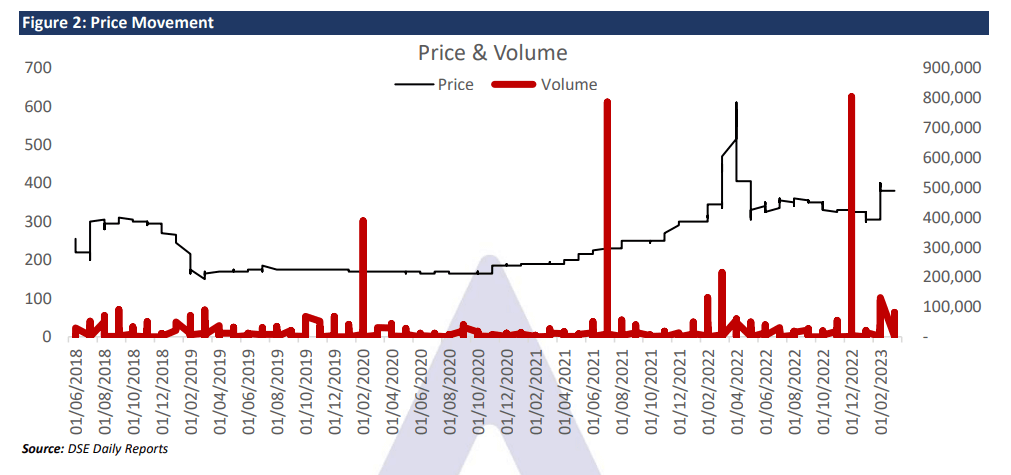

Counter performance on DSE

The total turnover of NICOL for the year 2022 was TZS 1.26bln from a volume of 3.43mln shares traded at a weighted average price (WAP) of TZS 368/-. The price opened the year 2022 at TZS 300/- and closed 8.3% higher at TZS 325/- following improved performance during the year.

The year’s highest price was TZS 610/- back in April, following NMB’s dividend growth that raised investors’ appetite for NICOL.

The price is already up 17% since the beginning of the year 2023 as NMB reported a 47% growth in profits, which is expected to reflect on NMB dividends. An aggregate of 508,213 NICOL shares were traded in January and February 2023, producing a turnover of TZS 186.4mln, while realizing a WAP of 367/- and an annualized turnover ratio of 4.6% compared to 6.3% for the year 2022. The WAP for February 2023 was TZS 381/-, somewhat 21% higher than the WAP for January 2023.

Valuation Drivers & Outlook

Key Assumptions

- Investment income growth at a CAGR of 19% for the next six years

- 50% dividend payout ratio.

- More than 85% of free cash flow after dividends and debt service are invested in Treasury bonds.

- No additional equity investment during the forecast period.

- The company’s Beta is 1.2x

- The cost of equity is 25.92%, the weighted average cost of capital is 23.22% and the terminal growth rate is 6%

• Different from the previous valuation, we added the Excess Return Method in the current valuation, to capture the net asset value component in the final value. Considering that the NAV indicates the current potential of the company, and while the risks that deter the price to match the NAV are still apparent, we thought the discount rate carries the weight of the risks, and so the final value should include a piece of the NAV. Since the cost of equity is higher than the ROE throughout the forecast period, thevalue arrived by the excess return method is 49.6% of the NAV.

• Increased EBIT and elevated income from the projected margin of the loan have also led to an upward shift of the discounted cash flow value.

• The dividend payout ratio has been revised upwards to 50% as the company secured a bank loan to finance diversification into real sectors. The initial worry was that the company would source financing from operational cash flow and distress dividend payments. It is important to note that the dividend for 2022 may be widely different from our forecast, since it is under the complete discretion of the board of directors.

Recommendation

Despite a weigh down from risks arising from expansion plans into real sectors, the company’s stable and reliable sources of income have enormous value and potential. At the time of publishing this report, the fair value is 34% higher than NICOL’s market price.

In that regard we issue a BUY recommendation, but with caution that investors should fully understand the associated risks.

Although investments into and returns from real sectors are still widely uncertain, we project income growth mostly from dividends, riding on the growth prospects of their most valuable asset, NMB stock. While banking sector profit grew nine times in the last five years, NMB is the most profitable bank in the economy, and second largest in terms of assets and deposits.

Moreover, marginal investments into Treasury bonds shall maintain a sustainable growth of interest income. The extra cost expected from new investments into real sectors is still uncertain until the company avails their investment plans.

The author of this article Imani Muhingo is the Head of Research and Analytics at Alpha Capital. For feedback contact him via email: imani.muhingo@alphacapital.co.tz