East Africa-focused gold producer Shanta Gold received Value Added Tax (VAT) refunds and offsets amounting to $5.7 million (approximately 13.4bn/-) in the first quarter for the Tanzania Revenue Authority (TRA), the company says.

The company in its Q1,2023 production and operational update released this week said it received a VAT offset of $4.6 million (approximately 10.82bn) , which was offset against its 2022 year-end tax liability and a cash refund of $1.1 million (approximately 2.85bn/-).

“The company’s Tanzanian VAT receivable increased from $29.3 million in Q4 to $32.0 million in Q1, 2023” the company said.

The company is positively engaging with the Tanzania Revenue Authority (TRA)to clear the outstanding balance.

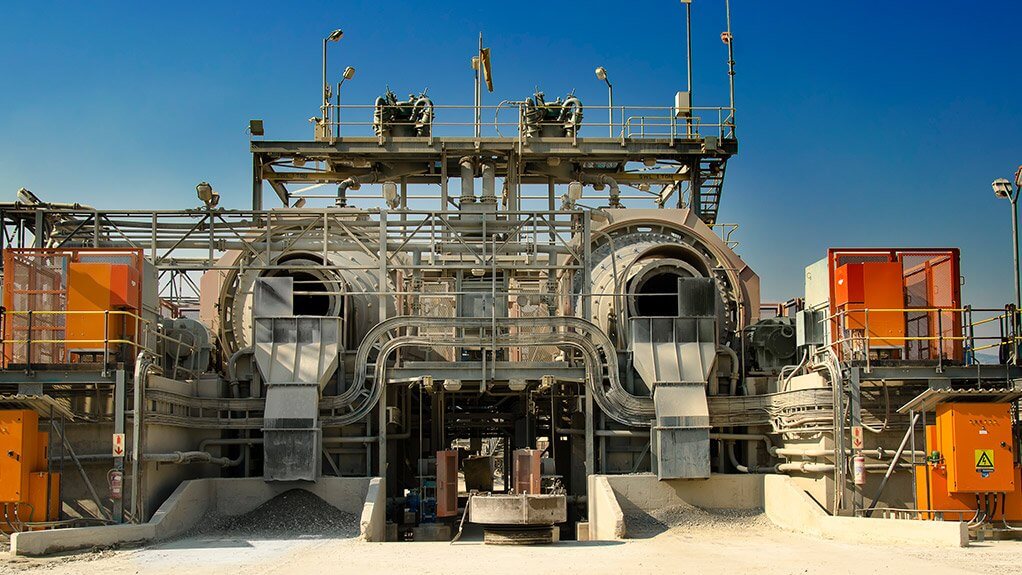

Shanta Gold achieved the first gold pour at its Singida gold mine, in Tanzania, on March 30, increasing production to about 100 000 oz/y of gold, the company highlighted in its quarter one production.

The ramp-up at Singida is progressing, with 2 200 oz produced in the first 22 days of April, the company reported.

“Shanta is now a 100 000 oz/y gold producer with a diversified resource base, a derisked balance sheet, and significantly more financial flexibility. Ramp up at the site is progressing well . We expect to announce our 2023 production guidance and five-year plan in this quarter,” said Shanta CEO Eric Zurrin, who will be stepping down after six years with the company at the end of quarter three, once the interim results are published.

The board has initiated a recruitment process to appoint a new CEO.

“The business today is vastly improved from that which [Zurrin] took over in 2017 and he has transformed Shanta from a single asset, single country gold producer encumbered with debt to a business with a diversified revenue base and . . . attractive exploration growth,” Shanta chairperson Tony Durrant said.

The New Luika gold mine, also in Tanzania, produced 15 317 oz in the same quarter.

Zurrin noted that this figure was slightly lower than budget owing to temporarily reduced availability of underground equipment in February, which was rectified in March, and generally excessive rains.

He said that, despite this, gold production for both January and March was above budgeted production, and that April production was on track for about 6 000 oz.

“We remain confident of hitting full-year guidance at the mine of 66 000 oz to 72 000 oz,” Zurrin said.

In terms of finances, the company had cash and available liquidity of $11.5-million at the end of March, along with gross debt of $29.1-million.