After experiencing a substantial surge in wealth earlier this year, Tanzanian billionaire brothers Aunali and Sajjad Rajabali have seen the market value of their stake in CRDB Bank decline by $2.8 million in the past 53 days.

CRDB Bank, headquartered in Dar es Salaam and with a strong presence in Burundi, holds a leading position in the East African financial services industry.

As the largest bank in Tanzania in terms of assets, customer deposits, and lending, CRDB Bank boasts an impressive total of nearly Tsh12 trillion ($5.1 billion) in assets as of Q1 2023.

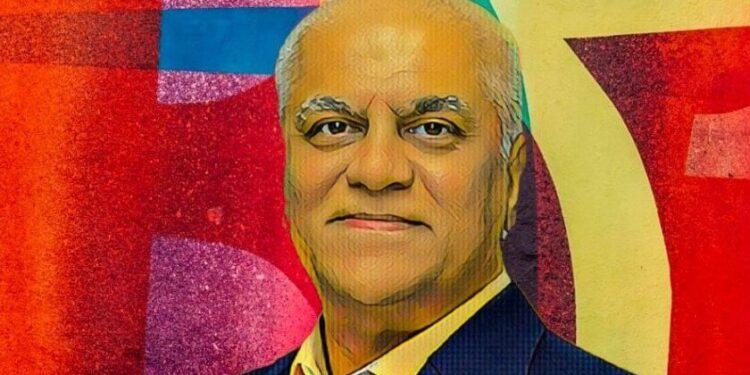

Tanzanian billionaire brothers, Aunali and Sajjad Rajabali, widely recognized for their vast wealth, maintain a combined 2.6 percent stake in CRDB Bank. This stake, valued at over $12.5 million, makes them prominent investors on the Dar es Salaam Stock Exchange.

Since April 24, the bank’s share price has plummeted by over 18 percent, dropping from 550/- ($0.23) to 450/- ($0.189). Consequently, shareholders and investors, including Aunali and Sajjad Rajabali, have suffered significant losses.

Within the past 53 days, the market value of the shares owned by the billionaire brothers has contracted by 6.69bn/- ($2.8 million), decreasing from 36.8bn/- ($15.42 million) on April 24 to 30.11bn/- ($12.61 million) on June 16.

Despite this setback, the Tanzanian billionaire brothers remain among the wealthiest investors on the Dar es Salaam Stock Exchange.

While their fortune may have diminished by $2.8 million due to the decline in CRDB Bank’s shares, Aunali and Sajjad Rajabali continue to rank among the richest individuals in the country.

The recent plunge in CRDB Bank’s shares comes as the bank mulls over expansion plans. Nearly three weeks ago, the bank unveiled its intentions to expand its footprint into three African countries: Zambia, Comoros, and Malawi. This expansion follows the bank’s rapid growth in the East African region and is in line with its strategic plan for 2023–2027.

By entering these markets, CRDB Bank demonstrates its unwavering dedication to expanding its regional presence and bolstering its financial performance, reinforcing its earnings and revenue streams.

Source: Billionaires.Africa