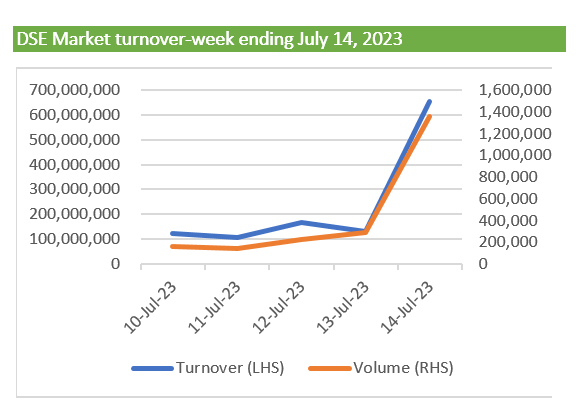

Market activities at the Dar es Salaam Stock Exchange (DSE) strengthened the journey into the green zone during the trading session last week posting a total turnover of 1.18bn/- being a 114% rise compared to 550.7m/- posted the previous week.

This increase can be attributed to the resumption of pre-arranged transactions from the previous week. Within the week, CRDB traded 1,031,320 shares on the pre-arranged board.

According to available data from the DSE, at the close of trading, total market capitalization increased by 1.44%, reaching a total of 15.309bn/- while the domestic market capitalization gained 0.19%, reaching 10.86bn/- by the end of the week.

The All Share Index (DSEI) closed at 1,835.88 points increasing by 1.44% while the Tanzania Share Index (TSI) closed at 4,108.17 points increasing by 0.19%

CRDB, NMB, and SWISS dominated the week’s trading session accounting for 75.08%, 7.49%, and 6.45% of the total market turnover, respectively.

Several stocks experienced price gains, with SWISS leading the way with a surge of 6.45%, closing at 1700 per share/- while CRDB recorded a 2.13% increase, ending the week at 480/- per share.

NICO saw a 2.11% increase, concluding the week at 485/- per share while TPCC had a 3% increase, closing the week at 4,120/- per share.

NMB was the only domestic stock that registered a price decline as its stock lost 0.57% of its value, ending the week at 3460/- per share.

According to the Zan Securities Chief Executive Officer Raphael Masumbuko, “We have a positive outlook for equities in 2023, with some local stocks still considered slightly undervalued despite positive earnings momentum and sentiment. Our analysis indicates that there will be record earnings growth this year, primarily driven by the banking, industry, and property sectors,”

Masumbuko added, “Looking ahead, we expect increased market activities in the coming weeks as companies prepare to release their second-quarter financial reports, generating more interest and trading”.