The financial sector performance in Tanzania remained robust, as attested by the growth of assets according to the latest Financial Stability Report released by the Bank of Tanzania (BoT).

The financial sector assets grew by 17.2 percent in 2022 compared to 13.7 percent in 2021, dominated by banks with 70.4 percent and pension funds with 25.6 percent.

The financial sector’s total assets as a percentage of GDP increased to 40.7 percent in 2022 from 34.7percent in 2021.

The Central Bank Governor Emmanuel Tutuba attributed the growth partly to increased lending to private sector, improvement in business conditions, and pick up of domestic growth trajectory.

Tutuba said the financial sector remained resilient to shocks amid challenges experienced from the war in Ukraine and global inflationary pressures.

“In 2022, the resilience of the sector was reinforced by measures undertaken by the Government and the Bank to limit the effects of the war in Ukraine and global inflationary pressures, such as accommodative monetary policy, fiscal measures as well as supervisory and regulatory interventions to ensure sustainability and the stability of the sector,” Tutuba said.

The resilience was also observed in non-bank financial institutions, which comprises social security, insurance and capital market, while financial system infrastructure continued to maintain efficiency through smooth operations for ensuring safety and reliability in payments hence enhancing financial stability and growth in the country.

Banking Sub-sector

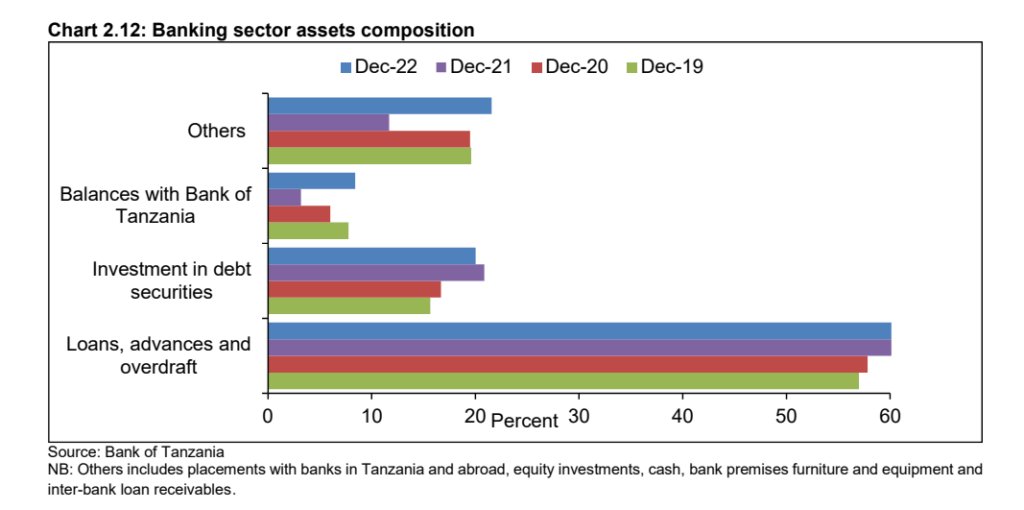

The banking sub-sector remained sound and stable with adequate capital, liquidity and subdued credit risks.

Total assets increased by 16.8 percent to 46.22bn/- in2022, mainly driven by increase in deposits.

The increase in deposits was attributed to the public confidence in the banking sector following the recovery of economic activities coupled with increased outreach through digital and agent banking.

Commercial banks continued to dominate the market in total assets, accounting for 97.1 percent. The banking sector deposits continued to be dominated by the top six banks that form part of systemically important banks, partly attributed to their wider branch networks and the use of agent banking and digital financial services.