The interbank foreign exchange market (IFEM) in Tanzania continued to face increased demand pressures driven by a shortage of foreign currency in September, attributed to turbulent events emanating from the global North according to the Bank of Tanzania Monthly Economic Review for October, 2023.

Measures to address the challenges have thus far heightened worldwide demand for the United

States dollar and in response, the Bank of Tanzania (BoT) intensified its intervention in the market, selling $150.5 million in September 2023, nearly doubling the amount ($73.5 million) sold in the preceding month.

Consequently, the shilling traded at an average rate of 2,476.9/- per US dollar, compared with 2,442.2/- per US dollar in August 2023, equivalent to an annual depreciation of 6.8 percent, from 2,318.07/- per US dollar in September 2022.

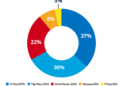

Meanwhile, the Interbank Cash Market (IBCM) continued to facilitate trading of shilling liquidity between banks. In September 2023, transactions totalled 2.30trn/-compared with 2.71trn/- conducted in the preceding month.

The transactions of 2-7 days constituted the largest share of total market turnover, accounting for 84.7 percent.

The overall IBCM and 2-7 days’ interest rates increased slightly to 5.46 percent and 5.50 percent, a bit higher than 5.24 percent and 5.36 percent registered in the previous month, respectively.

Similarly, the overnight interest rate increased slightly to 4.64 percent from 4.35 percent in the preceding month.

Repurchase Agreements

The Central Bank in September continued to conduct repurchase agreements (repo) with banks, although less aggressively than the previous month due to moderation of shilling liquidity in the banking system.

During the month under review, repos worth 312bn/- were auctioned, against the redemption of 416bn/ with the rate decreasing to an average of 2.43 percent from 2.91 percent in the preceding month.